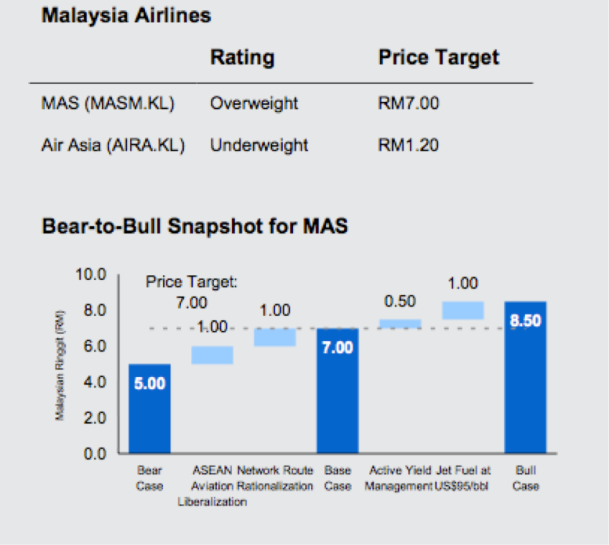

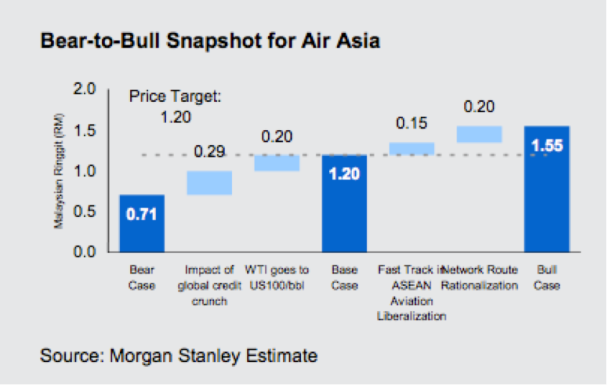

The industry view on the National Carrier – The Malaysia Airlines conclusively recommended the investment funds holding Air Asia to switch into Malaysia Airlines (MAS). On a risk-adjusted reward trade, a well-known researcher Morgan & Stanley see limited downside for MAS at the current price. Net cash accounts for more than 70% of market capitalization, and Morgan & Stanley believe the MAS share price could double if the carrier achieves its internal net profit target of RM0.7-1.0 billion for this year. In contrast, Morgan & Stanley (M&S) think Air Asia’s share price could see further downward pressure if oil prices and funding costs stay high.

Where M&S Differ:

While many like Air Asia’s low-cost business model, we think MAS has restructured its operation to be extremely competitive with Air Asia, and the carrier now has much better fundamental operating prospects than Air Asia does. The market appears to believe Air Asia will continue to take market share from MAS.

Malaysiaairlinesfamilies; however, believe drastic changes may affect Air Asia market share from MAS when Malindo Airways took off in March 2013. Many Malaysians are waiting in line to fly with Malindo Airways.

Why Morgan & Stanley Researchers Like MAS over Air Asia:

Disciplined growth strategy;

Sharply improving operating and pretax margin trend;

Prudent fuel hedging strategy;

Strong balance sheet and negative gearing; and

Attractive relative valuation.

Divergence in Relative Valuation: If we subtract net cash from MAS’ market capitalization, its franchise value is less than 1.0x EBITDA. In contrast, EV/EBITDA for Air Asia at 11.5x is expensive, given the inherent risks of potential fuel-hedging derivative contract losses and higher funding costs to finance capital expenditures for the next five years.

“Buy MAS, Sell Air Asia”

Brief notes about Morgan & Stanley:

Morgan Stanley does and seeks to do business with companies covered in Morgan Stanley Research. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of Morgan Stanley Research. Investors should consider Morgan Stanley Research as only a single factor in making their investment decision.

For analyst certification and other important disclosures, refer to the Disclosure Section, located at the end of this report.

+= Analysts employed by non-US affiliates are not registered pursuant to NASD/NYSE rules

The rating of MAS & Air Asia by Morgan Stanley in April 2008

MAS (RM3.60) is rated Overweight (RM7.00 price target) above;

While Air Asia (RM1.38) is rated Underweight (RM1.20 price target) below

Investment Case – Summary and Conclusions by Morgan & Stanley

In our initiation report on Air Asia, First-Mover Advantage in High-Growth Industry (30 June 2005), we provided a comparative analysis between Air Asia and Malaysia Airlines (MAS) on the domestic operation. Our conclusion was that even though Air Asia network capacity size is about 15% smaller than MAS’, Air Asia has significantly lower unit costs that more than offset its low unit yield when compared with MAS. The net impact was a wide divergence in operating profit: Air Asia recorded an operating margin of 20% while MAS reported a negative operating margin of 21% for the nine months ranging from July 2004 through March 2005.

Prior to MAS’ corporate restructuring exercise in 2006, Air Asia had little competition, and we believe the vastly inefficient and poorly capitalized MAS has made it easy for Air Asia to gain domestic and regional market share at the expense of MAS. We think the picture between the two carriers has changed dramatically since then, and MAS’ fortunes now appear to be rising at Air Asia’s expense. Our preferred aviation play in Malaysia is MAS, and we rate the stock Overweight with price target of RM7.00. We rate Air Asia Underweight and see fair value at RM1.20.

MAS versus Air Asia: Changing Fortunes

We highlight five reasons why we prefer MAS over Air Asia for the Malaysian aviation market.

I. Revenue Growth Strategy

For the past three years (2005-2007), Air Asia grew at an exceptional rate with RPK doubling to 9.86 billion and operating revenue rising 141% to RM1.6 billion at the end of June 2007. In contrast, RPK for Malaysia Airlines fell by 13% to 36.8 billion, but operating revenue rose 22% to RM14.9 billion at end of December 2007. In 2005, the domestic operation was part of the MAS network, but following a major corporate restructuring, the domestic operation was downsized. A significant portion of the domestic routes was transferred to Air Asia in 2006 as part of the government aviation policy of increasing competition. The growth comparison is also affected by the fiscal year changes – MAS changed its fiscal year to December from March in 2005, and Air Asia changed its fiscal year to December from June in 2007. Since we used an annualized 12-month period for our analysis, we think the fiscal year change should not affect the magnitude and direction of our analysis.

We think it is interesting to highlight that MAS was growing operating revenues by enhancing yield (indirectly higher fares) and other revenue sources, particularly cargo, while Air Asia grew its operating revenues sheer by an increase in passenger volume to gain market share.

MAS is expected to continue its steadily growth and path of growing RPK by 15% and operating revenues by 19%.

Malaysiaairlinesfamilies think MAS growth trend has got higher after the carrier took new delivery of its new A380 aircraft.

Of course, Air Asia or Group Tune Air would be recommending Air Asia to buy Tony Fernandez’s pipeline order of A380 aircraft to penetrate into Los Angeles routes competing painfully with MAS. That is what Tony Fernandez is all about in the aviation industry. All he cares is to KILL Malaysia Airlines just to save his stupid LOW CASTE Air Asia.

II. Operating and Pretax Margin Trends Over the 1995-97 period

MAS’ operating margin swung from a loss of 13.7% in F2005 to a profit of 3.0% in F2007. Air Asia’s operating margin declined from 14.1% in F2005 to 12.0% in F2007. The trend was similar for pretax margin. Air Asia’s declined to 17.3% in F2007 from 18.8% in F2005. The swing was more spectacular for MAS, rising from a loss of 13.3% in F2005 to a profit of 5.9% in F2007. A disciplined revenue growth strategy and tight control on operating costs led to the big earnings turnaround in MAS’ operation, and the operating margin gap between the two airlines has narrowed significantly since 2005.

The sharp divergence in operating and pretax margin performance between the two carriers should become more evident in the next two years. We expect Air Asia’s operating margin to rise to 19.4% in F2009 from 12.0% in F2007 but look for the pretax margin to drop further to 9.5% in F2009 from 17.3% in F2007. In contrast, we expect MAS to see an improvement in operating margin to 5.2% in F2009 from 3.0% in F2007 and anticipate a higher pretax margin of 6.4% versus 5.9%. While Air Asia will likely see pretax margin pressure from high net interest expense, MAS should benefit from net interest income primarily due to its huge net cash position.

III. Fuel Hedging Policy

We see a sharp contrast in fuel hedging strategies between the two airlines. MAS has adopted a conservative fuel hedging policy whereby it benchmarks its fuel hedging ratio against the average hedged ratio of its regional airline peers. The underlying fuel hedging philosophy is that MAS management does not want its airline operating performance to be significantly affected by volatile oil prices when compared to the other Asian airlines. In contrast, Air Asia takes directional bets on its oil position as part of its fuel hedging policy. In late 2007, Air Asia management sold call options at US$82.60/bbl for 150,000 barrels per month, and the call options will be triggered if WTI crude price averages US$90/bbl for the month. The premium from the call options was used to cover the insurance premium for buying puts at US$69/bbl and selling puts at US$55/bbl for 150,000 barrels per month.

While Air Asia management has effectively closed its directional oil position bet for 2008 by buying and selling more call/put options to neutralize the original fuel hedging contract position, the carrier still has directional bet for January 2009 to June 2010 call option position. If WTI oil prices stay above US$90/bbl during January 2009 and June 2010; the losses for Air Asia are likely to mount between the spot price and US$82.60/bbl. If oil prices trade substantially higher in the current environment due to the weak US$, we see an increasing risk that the derivative loss could be substantial, affecting both the operating and financial position of Air Asia.

Malaysiaairlinesfamilies believe the above is the cause of Air Asia being not sustainable as compared to Malaysia Airlines – the oil prices trade has increased the risk affecting both the operating and financial position of Air Asia which is why Air Asia needed desperately to cheat its customers and swindled the stupid fool in Khazanah – The Men-In-RED who holds the title with Stupid Fool (SF) Azman Mokhtar.

References can be found here;

Part I – Air Asia is a cheat Part I;

Part II – Ask Air Asia how to cheat customers – Tony Fernandez will answer;

Part III – Now Everyone Can Buy Air Asia Tickets but Cannot Fly;

MAS, however, does not have derivative exposure risk on its oil position. In F2008, the carrier has hedged 43% of its fuel requirement at the WTI crude oil price of US$89/bbl and another 13% at US$95/bbl for its fuel requirement in F2009.

IV. Financial Leverage

At the end of December 2007, net debt-to-equity for Air Asia was 158% (in June 2007, the gearing was 170%), whereas MAS had a net cash position. In F2009, we expect Air Asia’s leverage to rise to 227% as the carrier raises new borrowings to finance the aircraft acquisition.

However, we think shareholders’ equity for Air Asia is inflated with deferred income tax credits and the deferred losses from associates, and if we adjust the shareholders’ equity, the underlying net debt-to-equity for the carrier rises to 372%.

Despite the huge capital expenditure for the new aircraft order — MAS recently ordered 55 B737-800 aircraft for US$4.2 billion with 35 firm and 20 option – we forecast the carrier will still be in a net cash position in F2009, as the bulk of the capital expenditure will be incurred from F2010 onwards.

We believe MAS will raise debt capital in either 2009 or 2010 when capital market conditions are likely to be much improved from the tight liquidity credit crisis where funding costs have increased due to the rising credit default swap risks in the past months.

In contrast, Air Asia will have to raise RM2-3 billion a year for the next five years, and we estimate the carrier will need to raise RM2.8 billion for F2008.

Malaysiaairlinesfamilies saw as analyzed by Morgan & Stanley in 2008 where Air Asia needed to raise a minimum of RM2.8 revenue annually supposedly since F2008 to rescue Air Asia from Act 360 (Bankruptcy Act 1967); however it did not go well as expected due to fuel prices hiked unexpectedly where Air Asia in fact had declared losses consistently for two year from F2007 to F2008. The collaboration with MAS orchestrated by Air Asia was to have MAS profits siphoned out to save Air Asia which led MAS to declare for the first time in Malaysia industry; a mass record of RM2.52 billion loss.

All Air Asia and Group Tune Air board of directors had to have a backup plan saving Air Asia with reason to save themselves from conviction for Air Asia’s Bankruptcy incurring debt without reasonable ground of expectation of paying it.

Morgan & Stanley however think they favor MAS over Air Asia for 5 of the core reasons that included;

V. Relative Valuation

Perhaps the most important difference between the two carriers is the contrasting relative valuation. On franchise value, measured in EV/EBITDA, MAS trades at less than 1.0x compared with 11.5x for Air Asia. More interestingly, MAS’ net cash at RM4.4 billion at end of F2007 comprises about 73% of its current market capitalization of RM6.0 billion, which implies that the current franchise value is less than 1.0x its EBITDA (or cash flow).

Note – EV/EBITDA simply put by providing a simple, though incomplete, ratio of profit to value, EBITDA/EV is often used to estimate the cash return on an investment.

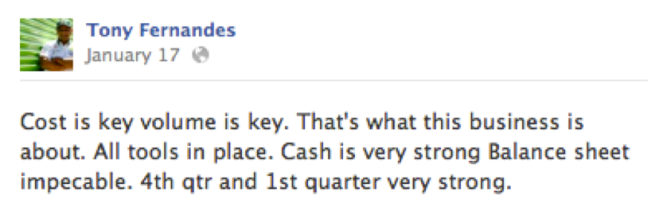

Morgan & Stanley is an international researcher for trading market etc. Even they understood Air Asia’s earnings are boosted by deferred income tax credit and contributed to an artificial strong balance sheet that again boosted by Tony Fernandez.

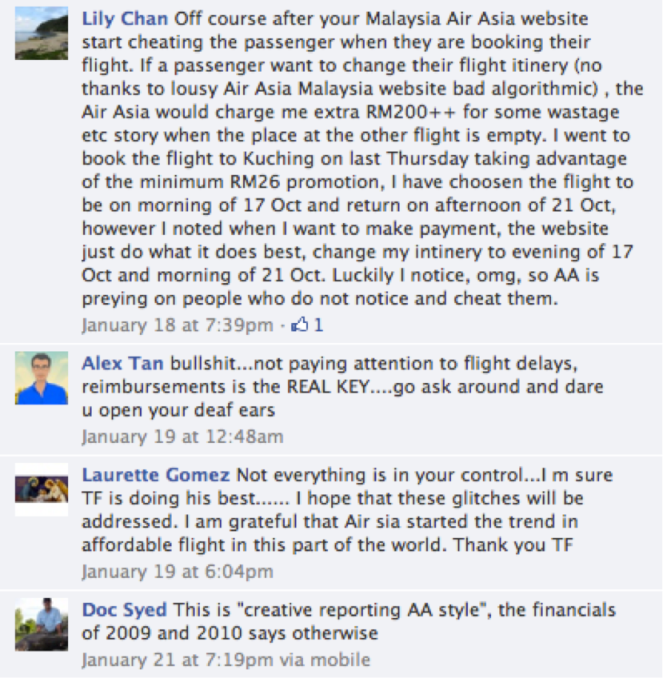

The public is not a fool and cannot be fooled; not for too long

Below is reply from Air Asia customers to Tony Fernandez above statement

The next remedy for saving Air Asia would be to conquer the Malaysia Aviation Industry by controlling the workers of the main Airlines in Malaysia i.e. Malaysia Airlines; Firefly; Air Asia and Malindo Airways.

Consequently the existence of the National Union for these airlines would save Air Asia but would kill the workers of Malaysia Airlines; Firefly and Malindo Airways. How could it happen? Stay tuned for our next episode.

Cheers from Malaysiaairlinesfamilies!

The stock market tells a different story, does it not?

Quick question: what were the closing prices of AirAsia and MAS shares on Bursa Malaysia last Friday?

Next question: how many analysts have “buy” and “sell” recommendations on AirAsia and MAS?

You are not implying that these analysts are a deluded lot, are you?

A third question: how many bailouts and restructurings has MAS gone through since it was set up post-MSA?

How much of public funds has it consumed using the excuse of being the”national flag carrier”?

Of course, it would be rude to ask why Singapore Airlines did better than MAS post-MSA ,

Gooberman seems to be speaking for Tony Fernandez. MAS is a gold mine; at least. Unlike Air Asia; nobody wants to buy the Cheating Low Caste Airlines. See that – the difference between MAS and Air Asia?

Yeah! SIA did well because it has been an alliance to STAR for ages and MAS just got into alliance with Oneworld. Soon Air Asia will be flooded with zero passengers and that’s what we figure out you need India to sustain the brand of Air Asia.

Cheers to Gooberman for Tony Fernandez! Yee Haa….times for you to wrap up and ciau super far away!