Failure of U.S. to subvert the Elections and Install a “Proxy Regime” reported by the Global Research

May 8, 2013 (LD) – Wall Street and London’s hegemonic ambitions in Asia, centered around installing proxy regimes across Southeast Asia and using the supranational ASEAN bloc to encircle and contain China, suffered a serious blow this week when Western-proxy and Malaysian opposition leader Anwar Ibrahim’s party lost in Malaysia 13th General Elections.

Malaysia 13th General Election on May 5, 2013 results shown the present ruling coalition won with majority leading Barisan National as the Malaysian new Government for 2013-2018. Najib Razak sworn as Malaysia Prime Minister for second term.

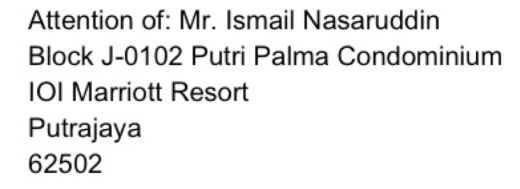

Image : Despite the US mobilizing the summation of its media power and pouring millions of dollars into the opposition party, including the creation and perpetuation of fake-NGOs such as Bersih and the Merdeka Center, Malaysian Prime Minister Najib Razak sailed to a comfortable victory in this year’s general elections. The cheap veneer has begun peeling away from America’s “democracy promotion” racket, leaving its proxies exposed and frantic, and America’s hegemonic ambitions across Asia in serious question.

Image : Despite the US mobilizing the summation of its media power and pouring millions of dollars into the opposition party, including the creation and perpetuation of fake-NGOs such as Bersih and the Merdeka Center, Malaysian Prime Minister Najib Razak sailed to a comfortable victory in this year’s general elections. The cheap veneer has begun peeling away from America’s “democracy promotion” racket, leaving its proxies exposed and frantic, and America’s hegemonic ambitions across Asia in serious question.

While Anwar Ibrahim’s opposition party, Pakatan Rakyat (PR) or “People’s Alliance”, attempted to run on an anti-corruption platform, its campaign instead resembled verbatim attempts by the West to subvert governments politically around the world, including most recently in Venezuela and in Russia in 2012.

Just as in Russia where so-called “independent” election monitor GOLOS turned out to be fully funded by the US State Department through the National Endowment for Democracy (NED), Malaysia’s so-called election monitor, the Merdeka Center for Opinion Research, is likewise funded directly by the US through NED. Despite this, Western media outlets, in pursuit of promoting the Western-backed People’s Alliance, has repeatedly referred to Merdeka as “independent.”

The BBC in its article, “Malaysia election sees record turnout,” lays out the well-rehearsed cries of “stolen elections” used by the West to undermine the legitimacy of polls it fears its proxy candidates may lose – with the US-funded Merdeka Center cited in attempts to bolster these claims. Their foreign funding and compromised objectivity is never mentioned (emphasis added) :

Allegations of election fraud surfaced before the election. Some of those who voted in advance told BBC News that indelible ink – supposed to last for days – easily washed off.

“The indelible ink can be washed off easily, with just water, in a few seconds,” one voter, Lo, told BBC News from Skudai.

Another voter wrote: “Marked with “indelible ink” and voted at 10:00. Have already cleaned off the ink by 12:00. If I was also registered under a different name and ID number at a neighbouring constituency, I would be able to vote again before 17:00!”

The opposition has also accused the government of funding flights for supporters to key states, which the government denies.

Independent pollster Merdeka Center has received unconfirmed reports of foreign nationals being given IDs and allowed to vote.

However, an election monitoring organization funded by a foreign government which openly seeks to remove the current ruling party from Malaysia in favor of long-time Wall Street servant Anwar Ibrahim is most certainly not “independent.”

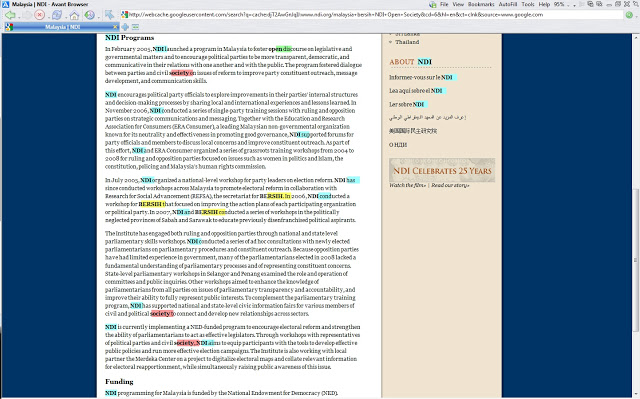

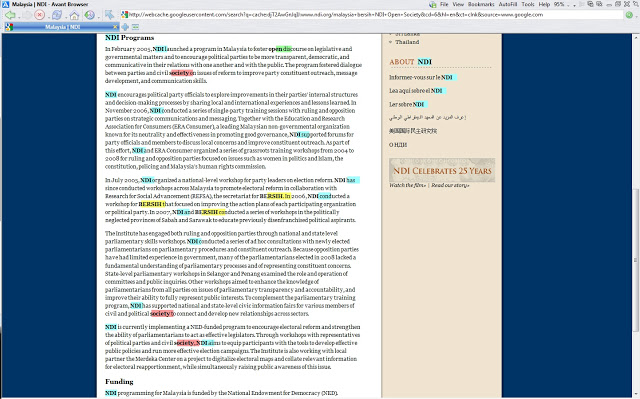

The ties between Anwar Ibrahim’s “People’s Alliance” and the US State Department don’t end with the Merdeka Center, but continue into the opposition’s street movement, “Bersih.” Claiming to fight for “clean and fair” elections, Bersih in reality is a vehicle designed to mobilize street protests on behalf of Anwar’s opposition party. Bersih’s alleged leader, Ambiga Sreenevasan, has admitted herself that her organization has received cash directly from the United States via the National Endowment for Democracy’s National Democratic Institute (NDI), and convicted criminal George Soros’ Open Society.

The Malaysian Insider reported on June 27, 2011 that Bersih leader Ambiga Sreenevassan admitted to Bersih receiving some money from two US organisations — the National Democratic Institute (NDI) and Open Society Institute (OSI) — for other projects, which she stressed were unrelated to the July 9 march.

A visit to the NDI website revealed indeed that funding and training had been provided by the US organization – before NDI took down the information and replaced it with a more benign version purged entirely of any mention of Bersih. For funding Ambiga claims is innocuous, the NDI’s rushed obfuscation of any ties to her organization suggests something far more sinister at play.

Photo: NDI’s website before taking down any mention to Malaysia’s Bersih movement.

Photo: NDI’s website before taking down any mention to Malaysia’s Bersih movement.

The mastermind behind NDI, the convicted criminal George Soros has planned for 30 years to invade Asia Pacific with his “DEMOCRACY” strategy. The move is to contain China in Asia Pacific using the homosexual leader Anwar Ibrahim – another ex-convict led his campaign in Malaysia under the DEMOCRACY pursuits following a closer monitoring on Thailand, Indonesia, Philippines, Afghanistan, China, Sri Lanka, Bangladesh, Burma, Cambodia, Hong Kong, Nepal and Pakistan. To change Malaysian longest ruling coalition is to bring in George Soros and his proxies – this is further escalated by the principle of Malaysian government over the imports from Israel.

Wake up Malaysians – read and remember this attempted invasion by George Soros!

The substantial, yet carefully obfuscated support the West has lent Anwar should be of no surprise to those familiar with Anwar’shistory. That Anwar Ibrahim himself was Chairman of the Development Committee of the World Bank and International Monetary Fund (IMF) in 1998, held lecturing positions at the School of Advanced International Studies at Johns Hopkins University, was a consultant to the World Bank, and a panelist at the Neo-Con lined National Endowment for Democracy’s “Democracy Award” and a panelist at a NED donation ceremony – the very same US organization funding and supporting Bersih and so-called “independent” election monitor Merdeka – paints a picture of an opposition running for office in Malaysia, not for the Malaysian people, but clearly for the corporate financier interests of Wall Street and London.

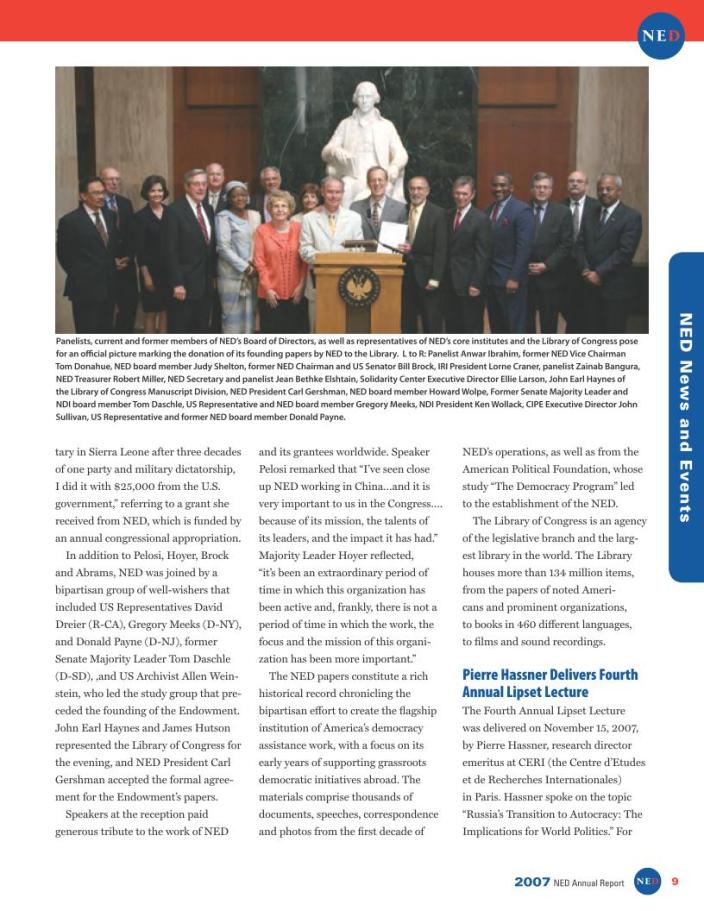

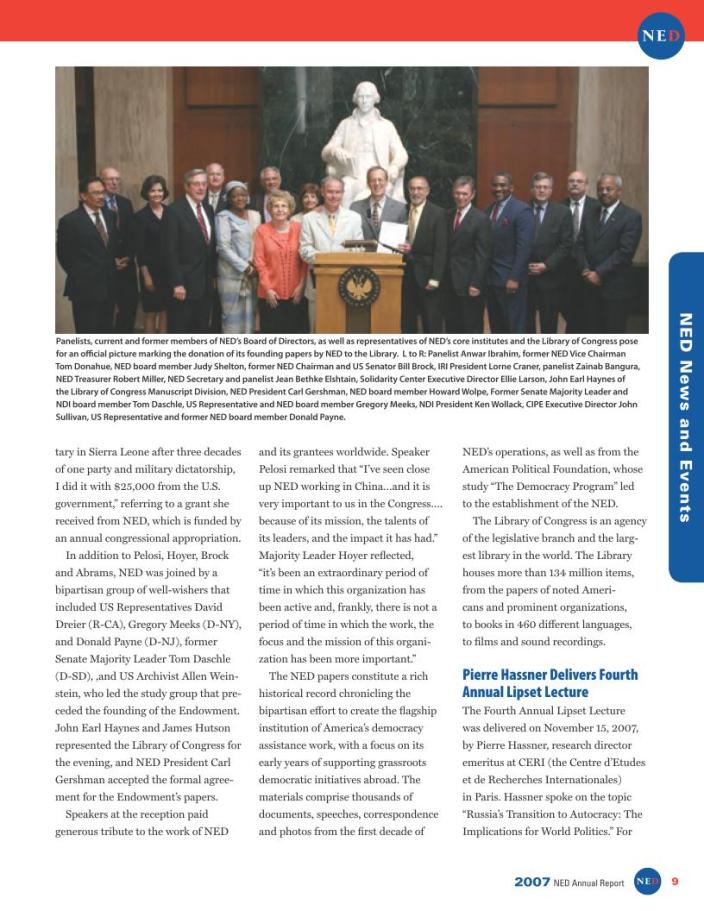

Photo: Taken from the US National Endowment for Democracy’s 2007 Democracy Award event held in Washington D.C., Anwar Ibrahim can be seen to the far left and participated as a “panelist.” It is no surprise that NED is now subsidizing his bid to worm his way back into power in Malaysia.

Photo: Taken from the US National Endowment for Democracy’s 2007 Democracy Award event held in Washington D.C., Anwar Ibrahim can be seen to the far left and participated as a “panelist.” It is no surprise that NED is now subsidizing his bid to worm his way back into power in Malaysia.

In reality, Bersih’s leadership along with Anwar and their host of foreign sponsors are attempting to galvanize the very real grievances of the Malaysian people and exploit them to propel themselves into power. While many may be tempted to suggest that “clean and fair elections” truly are Bersih and Anwar’s goal, and that US funding via NED’s NDI and convicted criminal, billionaire bankster George Soros’ Open Society are entirely innocuous, a thorough examination of these organizations, how they operate, and their admitted agenda reveals the proverbial cliff Anwar and Bersih are leading their followers and the nation of Malaysia over.

As Bersih predictably mobilizes in the streets on behalf of Anwar’s opposition party in the wake of their collective failure during Malaysia’s 2013 general elections, it is important for Malaysians to understand the true nature of the Western organizations funding their attempts to politically undermine the ruling party and divide Malaysians against each other, and exactly why this is being done in the greater context of US hegemony in Asia.

Anwar & Bersih’s US State Department Backers

The US State Department’s NED and NDI are most certainly not benevolent promoters of democracy and freedom. Does Boeing, Goldman Sachs, Exxon, the SOPA, ACTA, CISPA-sponsoring US Chamber of Commerce, and America’s warmongering Neo-Con establishment care about promoting democracy in Malaysia? Or in expanding their corporate-financier interests in Asia under the guise of promoting democracy? Clearly the latter.

The NDI, which Bersih leader Ambiga Sreenevasan herself admits funds her organization, is likewise chaired by an unsavory collection of corporate interests.

The average Malaysian, disenfranchised with the ruling government as they may be, cannot possibly believe these people are funding and propping up clearly disingenuous NGOs in direct support of a compromised Anwar Ibrahim, for the best interests of Malaysia.The end game for the US with an Anwar Ibrahim/People’s Alliance-led government, is a Malaysia that capitulates to both US free trade schemes and US foreign policy. In Malaysia’s case, this will leave the extensive economic independence achieved since escaping out from under British rule, gutted, while the nation’s resources are steered away from domestic development and toward a proxy confrontation with China, just as is already being done in Korea, Japan, and the Philippines.

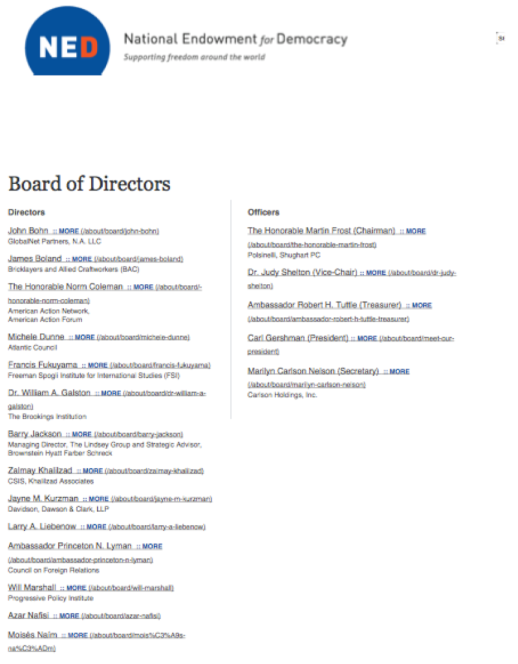

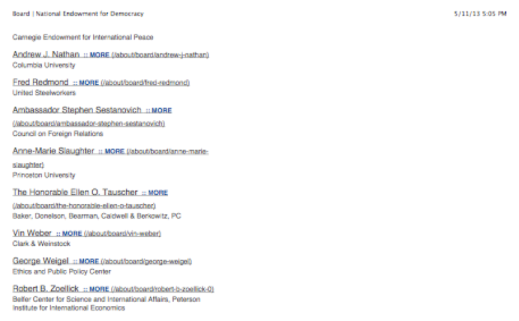

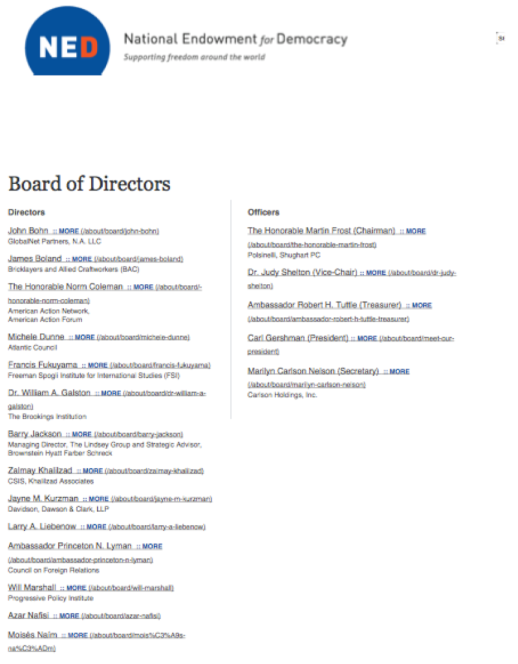

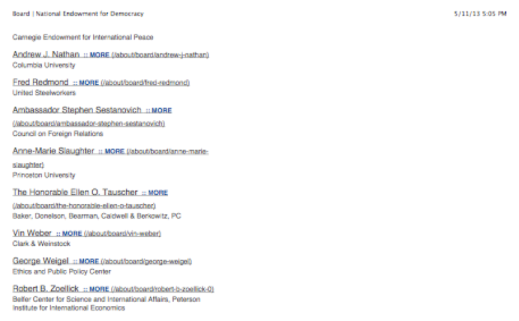

A quick look at NED’s board of directors reveals a milieu of corporate-fascists and warmongers:

- William Galston – Brookings Institution.

- Moises Naim – Carnegie Endowment for International Peace.

- Robert Miller – corporate lawyer.

- Larry Liebenow – US Chamber of Commerce (a chief proponent of SOPA, ACTA, and CISPA), Center for International Private Enterprise (CIPE).

- Anne-Marie Slaughter – US State Department, Council on Foreign Relations (corporate members here), director of Citigroup, McDonald’s Corporation, and Political Strategies Advisory Group.

- Richard Gephardt – US Representative, Boeing lobbyist, Goldman Sachs, Visa, Ameren Corp, and Waste Management Inc lobbyist, corporate consultant, consultant & now director of Ford Motor Company, supporter of the military invasion and occupation of Iraq in 2003.

- Marilyn Carlson Nelson – CEO of Carlson, director of Exxon Mobil.

- Stephen Sestanovich – US State Department, Carnegie Endowment for International Peace, CFR.

- Judy Shelton – director of Hilton Hotels Corporation & Atlantic Coast Airlines.

- Francis Fukuyama – Neo-Con, pro-war, pro-hegmonic PNAC signatory

- Zalmay Khalilzad – Neo-Con, pro-war, pro-hegmonic PNAC signatory

- Will Marshall – Neo-Con, pro-war, pro-hegmonic PNAC signatory

- Vin Weber – Neo-Con, pro-war, pro-hegmonic PNAC signatory

Before all of the names above are erased; here’s the evidence of proof;

Does Boeing, Goldman Sachs, Exxon, the SOPA, ACTA, CISPA-sponsoring US Chamber of Commerce, and America’s warmongering Neo-Con establishment care about promoting democracy in Malaysia? Or in expanding their corporate-financier interests in Asia under the guise of promoting democracy? Clearly the latter.

Does Boeing, Goldman Sachs, Exxon, the SOPA, ACTA, CISPA-sponsoring US Chamber of Commerce, and America’s warmongering Neo-Con establishment care about promoting democracy in Malaysia? Or in expanding their corporate-financier interests in Asia under the guise of promoting democracy? Clearly the latter.

The NDI, which Bersih leader Ambiga Sreenevasan herself admits funds her organization, is likewise chaired by an unsavory collection of corporate fascist interests.

Some select members include:

Robin Carnahan: Formally of the Export-Import Bank of the United States where she “explored innovative ways to help American companies increase their sale of goods and services abroad.” The NDI’s meddling in foreign nations, particularly in elections on behalf of pro-West candidates favoring free-trade, and Carnahan’s previous ties to a bank that sought to expand corporate interests overseas constitutes an alarming conflict of interests.

Richard Blum: An investment banker with Blum Capital, CB Richard Ellis. Engaged in war profiteering along side the Neo-Con infested Carlyle Group, when both acquired shares in EG&G which was then awarded a $600 million military contract during the opening phases of the Iraq invasion.

Bernard W. Aronson: Founder of ACON Investments. Prior to that, he was an adviser to Goldman Sachs, and serves on the boards of directors of Fifth & Pacific Companies, Royal Caribbean International, Hyatt Hotels Corporation, and Chroma Oil & Gas, Northern Tier Energy. Aronson is also a member of the Council on Foreign Relations (CFR) which in turn represents the collective interests of some of the largest corporations on Earth.

Sam Gejdenson: NDI’s profile claims Gejdenson is “in charge of” Sam Gejdenson International, which proclaims on its website “Commerce Without Borders,” or in other words, big-business monopolies via free-trade. In his autobiographical profile, he claims to have promoted US exports as a Democrat on the House International Relations Committee. Here is yet another case of conflicting interests between NDI’s meddling in foreign politics and board members previously involved in “promoting US exports.”

Nancy H. Rubin: CFR member.

Vali Nasr: CFR member and a senior fellow at the big-oil, big-banker Belfer Center at Harvard.

Rich Verma: A partner in the Washington office of Steptoe & Johnson LLP – an international corporate and governmental legal firm representing for Verma, a multitude of conflicting interests and potential improprieties. Setptoe & Johnson is active in many of the nations the NDI is operating in, opening the door for manipulation on both sides to favor the other.

Lynda Thomas: A private investor, formally a senior manager/CPA at Deloitte Haskins & Sells in New York, and Coopers & Lybrand Deloitte in London. Among her clients were international banks.

Maurice Tempelsman: Chairman of the board of directors of Lazare Kaplan International Inc., the largest cutter and polisher of “ideal cut” diamonds in the United States. Also senior partner at Leon Tempelsman & Son, involved in mining, investments and business development and minerals trading in Europe, Russia, Africa, Latin America, Canada and Asia. Yet another immense potential for conflicting interests, where Tempelsman stands to directly gain financially and politically by manipulating foreign governments via the NDI.

Elaine K. Shocas: President of Madeleine Albright, Inc., a private investment firm. She was chief of staff to the U.S. Department of State and the U.S. Mission to the United Nations during Madeleine Albright’s tenure as Secretary of State and Ambassador to the United Nation, illustrating a particularly dizzying “revolving door” between big-government and big-business.

Madeleine K. Albright: Chair of Albright Stonebridge Group and Chair of Albright Capital Management LLC, an investment advisory firm – directly affiliated with fellow NDI board member Elaine Shocas, representing an incestuous business/government relationship with overt conflicts of interest. Albright infamously stated that sanctions against Iraq which directly led to the starvation and death of half a million children “was worth it.”

The average Malaysian, disenfranchised with the ruling government as they may be, cannot possibly believe these people are funding and propping up clearly disingenuous NGOs in direct support of a compromised Anwar Ibrahim, for the best interests of Malaysia.

The end game for the US with an Anwar Ibrahim/People’s Alliance-led government, is a Malaysia that capitulates to both US free trade schemes and US foreign policy. In Malaysia’s case, this will leave the extensive economic independence achieved since escaping out from under British rule, gutted, while the nation’s resources are steered away from domestic development and toward a proxy confrontation with China, just as is already being done in Korea, Japan, and the Philippines.

Stitching ASEAN Together with Proxy Regimes to Fight China

Image: Lemuel Gulliver on the island of Lilliput, having been overtaken while asleep by ropes and stakes by the diminutive but numerous Lilliputians. Western corporate-financier interests envision organizing Southeast Asia into a supranational bloc, ASEAN (Association of Southeast Asian Nations), to use the smaller nations as a combined front to “tie down” China in a similar manner. Unlike in the story “Gulliver’s Travels,” China may well break free of its binds and stomp the Lilliputian leaders flat for their belligerence.

Image: Lemuel Gulliver on the island of Lilliput, having been overtaken while asleep by ropes and stakes by the diminutive but numerous Lilliputians. Western corporate-financier interests envision organizing Southeast Asia into a supranational bloc, ASEAN (Association of Southeast Asian Nations), to use the smaller nations as a combined front to “tie down” China in a similar manner. Unlike in the story “Gulliver’s Travels,” China may well break free of its binds and stomp the Lilliputian leaders flat for their belligerence.

That the US goal is to use Malaysia and other Southeast Asian nations against China is not merely speculation. It is the foundation of a long-documented conspiracy dating back as far as 1997, and reaffirmed by US Secretary of State Hillary Clinton as recently as 2011.

The present world order serves the needs of the United States and its allies, which constructed it – Robert Kagan, 1997

In 1997, Fortune 500-funded Brookings Institution policy scribe Robert Kagan penned, “What China Knows That We Don’t: The Case for a New Strategy of Containment,” which spells out the policy Wall Street and London were already in the process of implementing even then, albeit in a somewhat more nebulous manner. In his essay, Kagan literally states (emphasis added):

The present world order serves the needs of the United States and its allies, which constructed it. And it is poorly suited to the needs of a Chinese dictatorship trying to maintain power at home and increase its clout abroad. Chinese leaders chafe at the constraints on them and worry that they must change the rules of the international system before the international system changes them.

Here, Kagan openly admits that the “world order,” or the “international order,” is simply American-run global hegemony, dictated by US interests. These interests, it should be kept in mind, are not those of the American people, but of the immense corporate-financier interests of the Anglo-American establishment. Kagan continues (emphasis added):

In truth, the debate over whether we should or should not contain China is a bit silly. We are already containing China — not always consciously and not entirely successfully, but enough to annoy Chinese leaders and be an obstacle to their ambitions. When the Chinese used military maneuvers and ballistic-missile tests last March to intimidate Taiwanese voters, the United States responded by sending the Seventh Fleet. By this show of force, the U.S. demonstrated to Taiwan, Japan, and the rest of our Asian allies that our role as their defender in the region had not diminished as much as they might have feared. Thus, in response to a single Chinese exercise of muscle, the links of containment became visible and were tightened.

The new China hands insist that the United States needs to explain to the Chinese that its goal is merely, as [Robert] Zoellick writes, to avoid “the domination of East Asia by any power or group of powers hostile to the United States.” Our treaties with Japan, South Korea, the Philippines, Thailand, and Australia, and our naval and military forces in the region, aim only at regional stability, not aggressive encirclement.

But the Chinese understand U.S. interests perfectly well, perhaps better than we do. While they welcome the U.S. presence as a check on Japan, the nation they fear most, they can see clearly that America’s military and diplomatic efforts in the region severely limit their own ability to become the region’s hegemon. According to Thomas J. Christensen, who spent several months interviewing Chinese military and civilian government analysts, Chinese leaders worry that they will “play Gulliver to Southeast Asia’s Lilliputians, with the United States supplying the rope and stakes.”

Indeed, the United States blocks Chinese ambitions merely by supporting what we like to call “international norms” of behavior. Christensen points out that Chinese strategic thinkers consider “complaints about China’s violations of international norms” to be part of “an integrated Western strategy, led by Washington, to prevent China from becoming a great power.

What Kagan is talking about is maintaining American preeminence across all of Asia and producing a strategy of tension to divide and limit the power of any single player vis-a-vis Wall Street and London’s hegemony. Kagan would continue (emphasis added):

The changes in the external and internal behavior of the Soviet Union in the late 1980s resulted at least in part from an American strategy that might be called “integration through containment and pressure for change.”

Such a strategy needs to be applied to China today. As long as China maintains its present form of government, it cannot be peacefully integrated into the international order. For China’s current leaders, it is too risky to play by our rules — yet our unwillingness to force them to play by our rules is too risky for the health of the international order. The United States cannot and should not be willing to upset the international order in the mistaken belief that accommodation is the best way to avoid a confrontation with China.

We should hold the line instead and work for political change in Beijing. That means strengthening our military capabilities in the region, improving our security ties with friends and allies, and making clear that we will respond, with force if necessary, when China uses military intimidation or aggression to achieve its regional ambitions. It also means not trading with the Chinese military or doing business with firms the military owns or operates. And it means imposing stiff sanctions when we catch China engaging in nuclear proliferation.

A successful containment strategy will require increasing, not decreasing, our overall defense capabilities. Eyre Crowe warned in 1907 that “the more we talk of the necessity of economising on our armaments, the more firmly will the Germans believe that we are tiring of the struggle, and that they will win by going on.” Today, the perception of our military decline is already shaping Chinese calculations. In 1992, an internal Chinese government document said that America’s “strength is in relative decline and that there are limits to what it can do.” This perception needs to be dispelled as quickly as possible.

Kagan’s talk of “responding” to China’s expansion is clearly manifested today in a series of proxy conflicts growing between US-backed Japan, and the US-backed Philippines, and to a lesser extent between North and South Korea, and even beginning to show in Myanmar. The governments of these nations have capitulated to US interests and their eagerness to play the role of America’s proxies in the region, even at their own cost, is not a surprise. To expand this, however, the US fully plans on integrating Southeast Asia, installing proxy regimes, and likewise turning their resources and people against China.

In 2011, then Secretary of State Hillary Clinton unveiled the capstone to Kagan’s 1997 conspiracy. She published in Foreign Policy magazine, a piece titled, “America’s Pacific Century” where she explicitly states:

In the next 10 years, we need to be smart and systematic about where we invest time and energy, so that we put ourselves in the best position to sustain our leadership, secure our interests, and advance our values. One of the most important tasks of American statecraft over the next decade will therefore be to lock in a substantially increased investment — diplomatic, economic, strategic, and otherwise — in the Asia-Pacific region.

To “sustain our leadership,” “secure our interests,” and “advance our values,” are clearly hegemonic statements, and indicates that the US’ goal for “substantially increased investment,” including buying off NGOs and opposition parties in Malaysia, seeks to directly serve US leadership, interests, and “values,” not within US borders, but outside them, and specifically across all of Asia.

Clinton continues:

At a time when the region is building a more mature security and economic architecture to promote stability and prosperity, U.S. commitment there is essential. It will help build that architecture and pay dividends for continued American leadership well into this century, just as our post-World War II commitment to building a comprehensive and lasting transatlantic network of institutions and relationships has paid off many times over — and continues to do so.

The “architecture” referred to is the supranational ASEAN bloc – and again Clinton confirms that the US’ commitment to this process is designed not to lift up Asia, but to maintain its own hegemony across the region, and around the world.

Clinton then openly admits that the US seeks to exploit Asia’s economic growth:

Harnessing Asia’s growth and dynamism is central to American economic and strategic interests and a key priority for President Obama. Open markets in Asia provide the United States with unprecedented opportunities for investment, trade, and access to cutting-edge technology. Our economic recovery at home will depend on exports and the ability of American firms to tap into the vast and growing consumer base of Asia.

Of course, the purpose of an economy is to meet the needs of those who live within it. The Asian economy therefore ought to serve the needs and interests of Asians – not a hegemonic empire on the other side of the Pacific. Clinton’s piece could easily double as a declaration by England’s King George and his intentions toward emptying out the New World.

And no empire is complete without establishing a permanent military garrison on newly claimed territory. Clinton explains (emphasis added):

With this in mind, our work will proceed along six key lines of action: strengthening bilateral security alliances; deepening our working relationships with emerging powers, including with China; engaging with regional multilateral institutions; expanding trade and investment; forging a broad-based military presence; and advancing democracy and human rights.

And of course, by “advancing democracy and human rights,” Clinton means the continuation of funding faux-NGOs that disingenuously leverage human rights and democracy promotion to politically undermine targeted governments in pursuit of installing more obedient proxy regimes.

The piece is lengthy, and while a lot of readers may be tempted to gloss over some of the uglier, overtly imperial aspects of Clinton’s statement, the proof of America’s true intentions in Asia can be seen clearly manifested today, with the intentional encouragement of provocations between North and South Korea, an expanding confrontation between China and US proxies, Japan and the Philippines, and with mobs taking to the streets in Malaysia in hopes of overturning an election US-proxy Anwar Ibrahim had no chance of winning.

Clean & Fair Elections?

While the battle cry for Anwar Ibrahim, his People’s Alliance, and Bersih have been “clean and fair elections,” in reality, allegations of fraud began long before the elections even started. This was not because Anwar’s opposition party had evidence of such fraud – instead, this was to implant the idea into people’s minds long before the elections, deeply enough to justify claims of stolen elections no matter how the polls eventually turned out.

At one point during the elections, before ballots were even counted, Anwar Ibrahim declared victory – a move that analysts across the region noted was provocative, dangerous, and incredibly irresponsible. Again, there could not have been any evidence that Anwar won, because ballots had not yet been counted. It was again a move meant to manipulate the public and set the stage for contesting Anwar’s inevitable loss – in the streets with mobs and chaos in typical Western-backed color revolution style.

One must seriously ask themselves, considering Anwar’s foreign backers, those backers’ own stated intentions for Asia, and Anwar’s irresponsible, baseless claims before, during, and after the elections – what is “clean and fair” about any of this?

Anwar Ibrahim is a fraud, an overt proxy of foreign interests. His satellite NGOs, including the insidious Bersih movement openly funded by foreign corporate-financier interests, and the equally insidious polling NGO Merdeka who portrays itself as “independent” despite being funded directly by a foreign government, are likewise frauds – drawing in well-intentioned people through slick marketing, just as cigarette companies do.

And like cigarette companies who sell what is for millions essentially a slow, painful, humiliating death sentence that will leave one broken financially and spiritually before ultimately outright killing them, Anwar’s US-backed opposition is also selling Malaysia a slow, painful, humiliating death. Unfortunately, also like cigarettes, well-intentioned but impressionable people have not gathered all of the facts, and have instead have based their support on only the marketing, gimmicks, slogans, and tricks of a well-oiled, manipulative political machine.

For that folly, Malaysia may pay a heavy price one day – but for Anwar and his opposition party today, they have lost the elections, and the cheap veneer of America’s “democracy promotion” racket is quickly peeling away. For now, America has tripped in mid-pivot toward its hegemonic agenda in Asia, with Malaysia’s ruling government providing a model for other nations in the region to follow, should they be interested in sovereignty and independent progress – no matter how flawed or slow it may be.

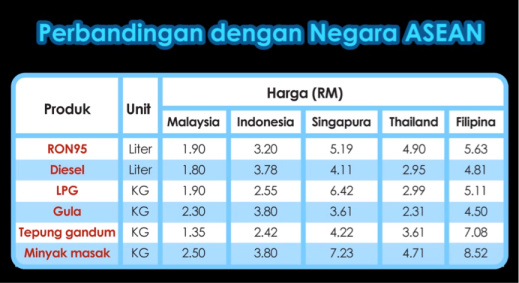

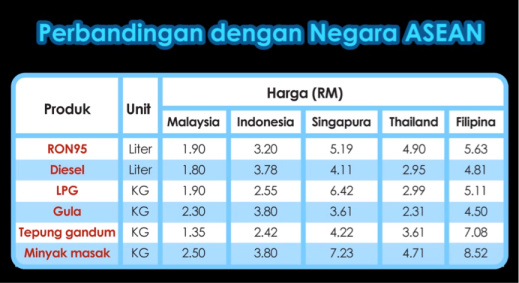

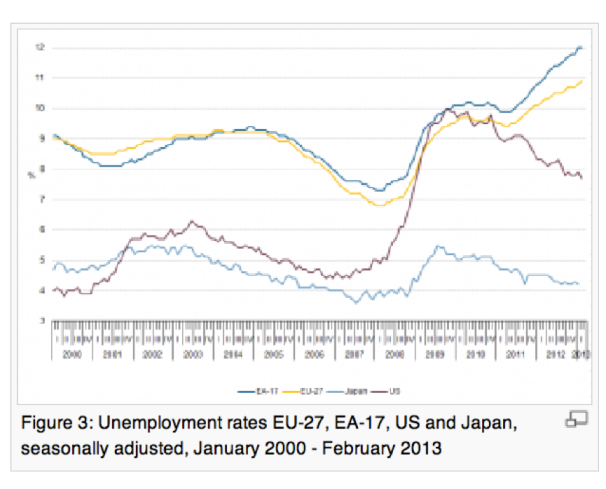

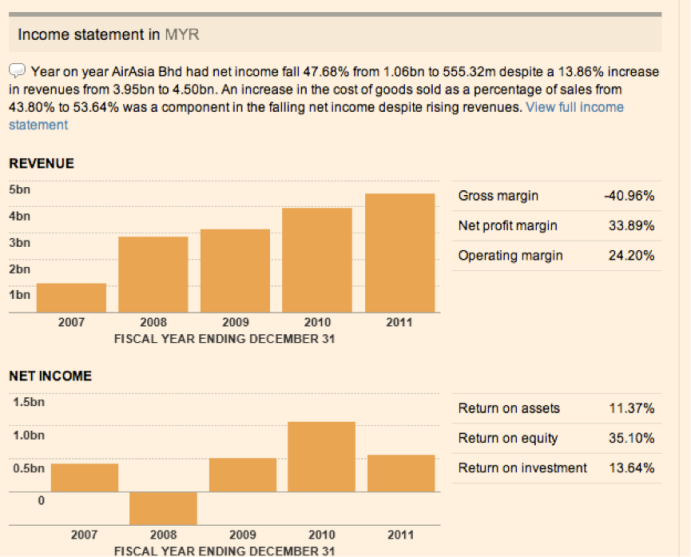

Malaysia may not enjoying these prices (below) if George Soros and US won its mastery game conquering through Anwar Ibrahim and BERSIH campaign. It’s time to restore the peace in Malaysia. Those Malaysians who are still sleeping please adopt reality check! Lesson to learn – George Soros thinks every Malaysians can be bought like Anwar Ibrahim and Ambiga; most Malaysians are stupid like the PKR supporters. 🙂